With benefits and allowances increasing from 10 April, now is the ideal time to make sure you, or the people you care for, are claiming everything to which they are entitled.

Annabel James, Founder of Age Space and an expert on elderly care, says: “Many older people don’t know about or are reluctant to claim all the allowances or benefits available to them. It can be time consuming and complicated looking into funding, but it is worth being persistent. Every year billions of pounds of benefits go unclaimed, and this financial help could help make life easier and more enjoyable in later life”.

According to charity Turn2us back in 2019, 6.41 million people aged 65 or over needed help with daily activities, but only 2.98 million claim attendance allowance or any other benefits helping them with their care needs. Its analysis of NHS figures shows 3.43 million could be missing out on money that is rightly theirs to claim.

Funding elderly care and later life can be complex, expensive, and unpredictable, particularly as needs change.

Here are some of the financial benefits seniors and carers can claim:

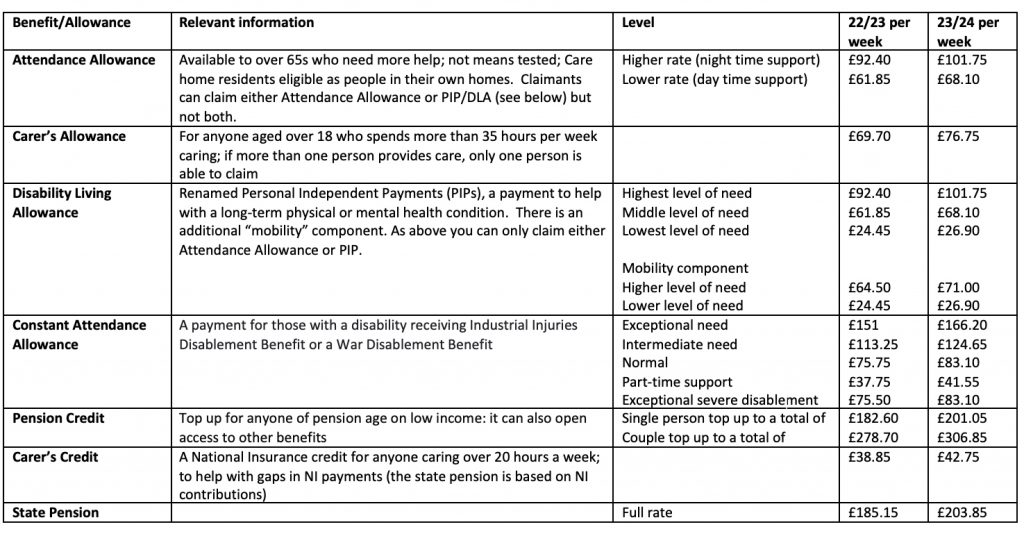

- Attendance Allowance: funding to help someone stay independent in their own home for longer. It is also possible to continue to receive it whilst living in a care home. This is available for people who are aged 65 and over and have a physical or mental disability, or an illness, that means extra help is needed. It’s not necessary to already be having help to be eligible. There are no restrictions on how the money should be spent. Attendance allowance in particular is a benefit that many don’t know about. It’s not means tested but based on individual need for every day help to stay living independently at home. There are two different rates, lower rate – £68.10 (23/24) a week and higher rate – £101.75 (23/24) a week if help is needed both in the day and at night, or for a terminal illness. The Attendance Allowance is paid every four weeks and is usually paid straight into a bank account.

- Carer’s Allowance: Carer’s Allowance is the main state benefit for people who spend 35+ hours every week providing care for someone. In order to qualify, the person they care for must be in receipt of some specific benefits. There is a limit to how much you can work/earn while receiving Carer’s Allowance, but the actual payment is not means tested (not based on your income). Some benefits also enable you to claim other benefits, or for example, a carer spending more than 35 hours a week caring for someone in receipt of Attendance allowance is eligible themselves for Carer’s Allowance. The Carer’s Allowance is taxable and can affect other benefits that you maybe currently receiving. If there are multiple carers for the individual, only one of the carers is entitled to receive Carer’s Allowance.

- Constant attendance allowance – available for those with a disability receiving industrial injuries, disablement benefit or a war disablement benefit.

- Disability living allowance (DLA) or Personal Independent Payments (PIPs) – help with a long-term condition or mental health condition. You can’t receive both DLA/PIP and Attendance Allowance.

- Pension credit – top up available to anyone of pension age on low income: it can also open access to other benefits.

- Carer’s credit – a National Insurance credit for anyone caring over 20 hours a week to help with gaps in NI payments.

- Free TV licence – once you or someone you live with are over 74 you are eligible to apply for a free TV Licence for your household.

- Free NHS, dental treatment, and glasses – free prescriptions for all over 60s and depending on your circumstances help is also available in other areas.

- Warm home discount scheme, cold weather payments and winter fuel payments – one-off payments to help with the cost of energy during the winter for those with a pension.

- Council tax discount – Council Tax Support is available dependent on which benefits you receive, your age, income, savings, who you live with and how much Council Tax you pay. Carers who look after someone in the household for at least 35 hours a week and who meet additional criteria may be disregarded for Council Tax purposes.

Increase in benefits and allowances for 2023/2024

Find out more about all the care funding options available with this simple guide from Age Space: https://www.agespace.org/finance/funding-elderly-care.